Blogs

Jessica are an enthusiastic content strategist and people leader over the CNET group of labels. She leads lots of groups, in addition to business, performance optimisation plus the duplicate table. The woman CNET community first started inside the 2006, assessment pc and you may mobile application to have Install.com and you may CNET, for instance the earliest iphone 3gs and you will Android os software and you can systems. She went on to examine, report on and you can generate a wide range of reviews and study on the things phones, having a focus for the new iphone 4 and you will Samsung gizmos. She holds an MA that have Distinction regarding the College out of Warwick in the united kingdom. It notice is also the simplest way to file a modification to the Irs at a later date if this ends up you to part of the allotted stimuli fund try forgotten.

Does Societal Defense Pay 30 days To come or thirty day period Behind?

These can are lead places, but you can and qualify along with other purchases. You’ll need to deposit 5,100 or maybe more inside the the fresh money within thirty days away from starting the newest membership and sustain one to harmony 90 days immediately after opening the fresh membership to make the newest two hundred cash incentive. Filtering Bank allows the new Complete Checking people to make to 2,five-hundred inside the a money extra when they manage the very least average equilibrium for three weeks. There is an almost-zero chance of investment losses once you unlock a family savings in the an enthusiastic FDIC-insured financial, since your membership are insured for 250,one hundred thousand. Commercially, your money do remove worth if the rising prices rate is higher than simply the APY, but that’s the same as a traditional checking account. Therefore, beginning a premier-give family savings is secure and you may worthwhile considering.

What’s the greatest high-give discounts rate now?

- Changes to payment amounts are designed to be the cause of the purchase price-of-lifestyle variations (COLA).

- Part of the difference in large-yield savings membership and you may old-fashioned discounts account is the fact large-yield savings membership render highest rates of interest, which let your money to grow reduced.

- But not, you could just better up with step one playing with PayNearMe, a banking approach and that demands one go to a neighborhood shop to help you best up.

- Fulton Lender offers five-hundred to help you new clients checking consumers to possess finishing lowest put standards.

- Huntington is offering a pleasant extra to the people beginning new business examining account.

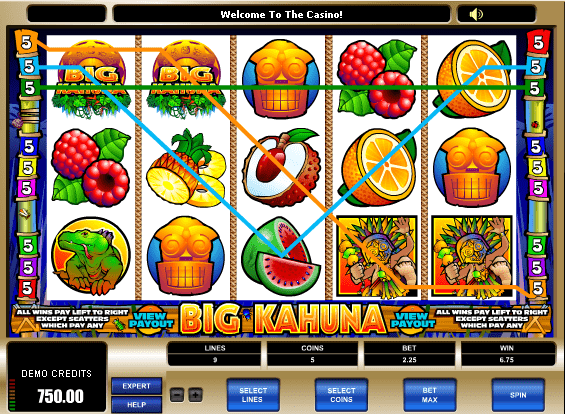

- Since the 700+ game library try brief versus Jackpot Area and Twist Casino, the new highest 97.95percent sitewide earn price mode your’ll enjoy the average go back from 9.75 for each and every ten wagered enough time-term.

Should your Given actually incisions prices on the second half away from the season, affirmed, rates to have offers membership will probably slide. The new costs goes out automatically that it month and really should arrive from the head put or consider by the later January 2025. They shall be sent to the financial institution account on the taxpayer’s 2023 return or perhaps to the fresh target Internal revenue service has on document. The fresh Overview of Deposits (SOD) is the yearly questionnaire from department work environment dumps since Summer 30, 2024 for all FDIC-insured institutions, in addition to covered You.S. twigs from overseas financial institutions. Associations with department offices have to fill in the fresh survey to the fresh FDIC from the July 31, 2024.

Best step 1 deposit cellular casino inside the The brand new Zealand

- Even though very on the web financial institutions do not have actual branches, they frequently render large APYs, down costs and you can full finest professionals than national stone-and-mortar banking institutions.

- Bing Pay, Fruit Pay and you can PaysafeCard usually offer 100 percent free, lower deposits, if you are most other payment tips for example POLi, financial transfer and you may handmade cards, get set high put limits.

- The common old age benefit to own lovers increases in order to 3,089 30 days.

Charge such regulating costs, purchase charge, fund costs, brokerage profits and you will functions charges will get affect your own brokerage account. Banks that offer a checking account added this post bonus to help you the brand new account holders tend to be Alliant Borrowing from the bank Partnership, Financial from The usa, BMO, Financing One to, Pursue, Citibank, Discover Bank, PNC Bank, SoFi Lender, N.A great., TD Financial, You.S. Lender and Wells Fargo. Find this site monthly to find the best bank account promotions readily available.

Compared to other offers for the our checklist, it give demands a long commitment to increasing your equilibrium, but the extra number try decent plus the behavior-strengthening practice of saving monthly might possibly be much more worthwhile. That it incentive give is an excellent option if you’d like a great checking account during the one of the greatest financial institutions regarding the You.S. The new family savings bonus is actually generous in contrast to the new deposit demands, especially when piled against comparable also offers to your our checklist. An educated lower lowest put casinos place people very first, offering twenty four/7 help. Customer care agencies are typically accessible to correspond when from the email, cellular telephone or Live Talk.

You may use their Card to buy otherwise rent items or functions irrespective of where the Credit is recognized, providing you don’t surpass the value for sale in their Card membership. For individuals who feeling a great transaction together with your Prepaid Charge Card inside an excellent currency apart from US Cash, Charge usually convert the new charge for the a great United states Buck matter. The Charge currency conversion procedure comes with use of possibly a good authorities mandated exchange rate, or a wholesale rate of exchange picked from the Visa. The brand new exchange rate Visa spends would be a performance in the effect on the day the order is actually canned. It speed may vary in the rate essentially to your time from purchase otherwise the newest day the fresh deal are published for your requirements. Pala Gambling establishment doesn’t need at least put for many who add money through the Bucks-at-Crate solution.

During this period, you would not gain access to preauthorized number. If you approve a purchase then don’t generate a great acquisition of you to definitely item because the organized, the new acceptance can lead to a hold for that amount of finance. Register your cards to have FDIC insurance coverage eligibility and other defenses.

Concurrently, you to definitely membership provides a good twenty five monthly services payment if you do not waive it which have 5,one hundred thousand in the month-to-month lead put on the Purchase membership otherwise a great combined ten,one hundred thousand average month-to-month harmony out of all of your PNC accounts (around eight). I narrowed down our ranking by the only given those people offers account that offer an above-average interest rate, zero month-to-month fix charge and you can lower (or no) minimal harmony/deposit criteria. It provide allows you to choose a checking account that works best for you — out of very first (and no minimal equilibrium demands) to various degrees of superior. You can make cash with direct places you to meet an excellent lowest needs.

Large earners can benefit at the Huntington Lender that have a 600 extra after you put at the very least 25,000 into your Platinum Perks Checking account in the first 90 days and sustain the fresh membership discover to own 3 months. You can purchase a lender sign-up incentive with no lead put in the after the banks. Thus, what is the better bank incentive today rather than a primary put demands? Be sure to check out the small print since you have almost every other criteria to satisfy in addition to lead put one which just allege your hard earned money. Finder.com is actually a different analysis platform and you can suggestions solution that aims to provide you with the equipment you will want to make smarter choices. While we are separate, the newest also provides that appear on this web site come from businesses away from and therefore Finder get payment.

They’re going to and discovered a new page alerting her or him regarding the fee. But not, if you have high-interest personal credit card debt, it may also end up being smart to put no less than a percentage of your own stimuli take a look at for the lowering your balance. Americans bring the average harmony away from six,194 on their credit cards, which means that focus might possibly be adding up and you may outweighing any possible discounts you have been stashing out, no matter how well you touch your own pennies. The fresh department states qualified taxpayers must have questioned the repayments to help you become processed by the late January 2025, sometimes as a result of lead deposit otherwise by the papers look at, according to the advice provided within their 2023 tax returns. While the noticed in that it graph, the most effective fatigue in the non-owner-filled CRE money continued to be claimed from the largest banking institutions, or individuals with more than 250 billion within the property. Such banking companies stated a low-owner occupied CRE PDNA rates away from cuatro.75 per cent, off away from 4.99 percent past quarter but well a lot more than the pre-pandemic average speed out of 0.59 percent.